A Random Walk with Skybridge's Scaramucci

Jun 10 2016 | 9:22pm ET

Editor’s note: An interesting element of our recent in-depth conversation with Skybridge CEO Anthony Scaramucci was a rapid-fire Q&A that covered everything from his short list of essential business books to the 2016 Presidential election and the resurrection of Wall Street Week.

What is the best investment that you have ever made? SkyBridge. I twice left safe, lucrative careers at prestigious financial institutions to start my own businesses, and betting on myself has paid off many times over.

What should every investor know about hedge funds? Rather than focus on fees and short-term returns, focus on net performance over the course of a 5 to 7 year business cycle. A portfolio isn’t truly diversified without the volatility-smoothing and risk-mitigating effects of an alternatives allocation.

Your essential book(s) on business and finance? You can’t go wrong starting with “The Intelligent Investor,” by Benjamin Graham, but I have to go with, “A Random Walk Down Wall Street,” by Burton Malkiel. It was the first book I picked up when I decided to pursue a career on Wall Street, and it provided a great framework for understanding asset allocation and the psychology of successful long-term investing.

What are you reading now? “Sapiens: A Brief History of Humankind,” by Yuval Harari.

Why did you get involved in GOP politics? First, and most importantly, I love my country and believe in the importance of its leadership role in the world. Second, as a taxpayer I consider myself a stakeholder in the American government, so I figured I should do what I can to make sure money is being put to the best use.

You supported Jeb Bush at the outset. Why did his primary campaign fail? Governor Bush was by far the most qualified candidate left in the race, but it became clear that the American electorate wanted something different in this cycle. The middle-class voter is frustrated by the lack of wage growth and erosion of homeland security in this country during the last 20 years, and wants someone to disrupt the status quo.

What has been the GOP’s biggest failure in recent years? The failure to effectively communicate to disaffected voters in both parties how free market-oriented policies are better-positioned than an entitlement society to close the income gap and empower people to lift themselves out of poverty.

You know Donald Trump personally. What advice do you have for him? Start acting more presidential and make peace with the so-called Republican establishment. By March he had already blazed a clear path to the nomination, but instead of beginning the transition to general election-style rhetoric and coalition-building, he doubled down on attacks alienating women and minority voters that will be crucial to winning the White House.

Will you support Trump if he gets the nomination? I am a loyal Republican and plan to support the nominee. It would be both a mistake for the Republican Party to ignore the voters energized by Trump’s message, and a mistake for him to eschew the type of guidance the GOP establishment could provide.

Where are Democrats most vulnerable this election? They’re vulnerable because the presumptive nominee is fundamentally distrusted by a large swath of the American people. She’s running against a 74-year-old socialist with little grasp of policy, and only leading by a comfortable margin because of her command of superdelegates.

What would you consider to be the biggest success of the Obama administration? The President has been relatively pragmatic in not delivering any shocks to the American economy during a very fragile time.

Its biggest failure? The hubris to think he could govern effectively without compromise.

Where are you on climate change? The science of climate change is pretty much irrefutable at this point, and I find it tragic that so many people in this country believe global warming is some sort of elaborate hoax perpetuated by every credible scientist on the planet. In addition to the whole humanity angle, investing in sustainable energy makes sense from an American national security perspective.

Do you think we should close Guantanamo? That’s a tough one. In this environment, we have to keep it open.

Should the Fed be audited? I don’t think people who suggest “auditing the Fed” have any idea what they’re talking about; we know what securities the Fed owns. In general, I think some of the most dangerous things going on right now in this country are politically motivated attempts by Congress to intervene into the affairs of independent bodies like the Federal Reserve and Supreme Court.

What should the federal minimum wage be? I don’t think raising the federal minimum wage would have the desired effect—it would lead to a loss of jobs and accelerate the push into automation. Much more sound policy would be Warren Buffett’s idea of an expanded earned income tax credit and a reduction of the corporate tax rate.

What two political reforms would you enact if you could? I would make campaign finance more straight forward and transparent, and I would put term limits on members of Congress.

Will you ever run for public office? No, I believe I can make a bigger dent in the universe from the private sector.

Which fund measurements do you watch most carefully? Net performance against the benchmark over a full business cycle and the Sharpe ratio.

Whose presentation at SALT has been the most memorable? President Bill Clinton’s keynote in 2010 stands out to me not only because it was brilliant and engaging, but also because it came during the second-ever iteration of the conference and helped launch SALT deeper into the industry’s consciousness.

You have tweeted from @Scaramucci more than 10,000 times. How do you find the time?I’m a narcissist with severe attention deficit disorder who doesn’t get very much sleep.

Has our culture become too politically correct? Are “micro-aggressions” real? Yes, and I think it’s another manifestation of social media where our brains are wired to seek instant gratification. People too often jump to conclusions without waiting for facts. In fact, you asking this question is a micro-aggression.

What is the last website that you check every day? The ESPN app to check the Mets score (if I wasn’t at the game).

You are a member of the Mets owners’ group. How many games will they win this year?We’ll win 89 games and nip the Washington Nationals for the NL East title. I can’t wait to watch this talented young pitching staff—and a lineup featuring Yoenis Cespedes—for an entire season.

How about those Cubs? They’ve put together an extremely talented young team that could very well lead the league in wins this year. I think the Mets and Cubs will meet in the NLCS several times in the next decade—and the rivalry will be great for the game.

Favorite musical artists, living and dead? I’m an Italian from Long Island, do you really have to ask? Frank Sinatra, Andrea Bocelli and Billy Joel. For my Irish brethren, I also love U2.

Who are your political heroes? Abraham Lincoln and Ronald Reagan.

Who is your investment hero? Warren Buffett.

What prompted your resurrection of Wall Street Week? The current financial media has become too short-term focused, a product of the social media soundbite generation. For 35 years Louis Rukeyser gave everyday people a show where they could learn about creating long-term wealth, and I wanted to pick up the baton to carry on that mission.

What is wrong with “buy and hold” investing? Absolutely nothing. You should invest and construct a portfolio based on your own personal goals.

What percentage of hedge funds are worthy of investors’ capital? Tough to put a percentage on it, but I would say less than 20%. Actively managing money is difficult and it takes a special skill set to achieve consistent returns.

Do you still believe that the U.S. economy is in a “statistical recession”? I don’t, but stagnant middle-class wage growth has made it feel to most Americans like we’re in a prolonged recession.

Will the U.S. equities market correct 10% (again) before the election? It certainly wouldn’t surprise me given how much Dodd-Frank has reduced liquidity and exacerbated volatility, but I don’t envision another correction before the election for one simple reason: The powers-that-be, from central bankers to Chinese government officials, are terrified of the effect a Trump Presidency would have on the global economy, and won’t risk boosting his candidacy by doing anything that could destabilize markets.

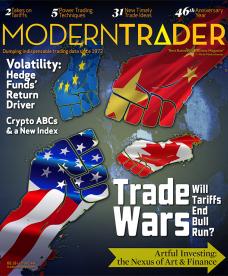

This article originally appeared in the June issue of Modern Trader

Related Links

More News

- Hedge Fund Launches Exceed Liquidations for Second Consecutive Quarter

- Neudata Launches Unique Alternative Data Use-Case Research Platform

- Private Equity Drives Value of Jersey Funds Business To Record Levels

- HFRX Global Hedge Fund Index Up +0.19% Through Mid-March

- Tullett Prebon Announces Launch of Alternative Asset Backed Lending Desk

- Cressey & Company Announces Andy Hurd as Operating Partner

- Rational Funds Converts Second Hedge Fund

- Northern Trust Strengthens Private Equity Audit via Blockchain Technology with PwC

- Fidante Acquires Minority Stake in Latigo Partners

- Preqin: High Valuations Are Top Concern For Private Debt Managers

- Maitland Hires Ferrara As Senior Client Service Manager

- Eurekahedge: Hedge Fund Down -1.64%, the worst monthly loss since May 2010

- Preqin: Private Equity Buyout Funds Focus On IT Sector

- Seward & Kissel Study: Continued Flight From Equity Among New Funds

Eurekahedge: Hedge Fund Index Down 0.54% in March

In Depth

PAAMCO: Will Inflation Deflate the Asset Bubble?

Jan 30 2018 | 9:49pm ET

As the U.S. shifts from monetary stimulus to fiscal stimulus, market pricing should...

Lifestyle

CFA Institute To Add Computer Science To Exam Curriculum

May 24 2017 | 9:25pm ET

Starting in 2019, financial industry executives sitting for the coveted Chartered...

Guest Contributor

Boost Hedge Fund Marketing ROI By Raising Your ROO

Feb 14 2018 | 9:57pm ET

Tasked with delivering returns on client capital, a common dilemma for many alternative...